What is the Solar Investment Tax Credit? And Why do these upcoming changes matter? While these changes might not impact a residential owner as significantly, when dealing with large scale Commercial and Utility projects, 4% goes a long way and can save thousands.

The Solar Investment Tax Credit

In order to encourage the growth of solar energy, the federal government implemented an incentive program in the form of tax credit for a portion of the price of the solar energy system. The Solar Investment Tax Credit was put into place to invigorate the market and encourage further research and development in solar energy, in hopes that the price of solar would be driven down and the credit could be phased out. When the credit was established by the Energy Policy Act of 2005, it was only supposed to last for 2 years. After an extension, the end date was set for 2016. That is until experts pushed for another 5 years of the credit so the industry could fully mature. Here are the details as it currently stands.

- Changes in the Credit Percentage

The ITC is currently at a 26% tax credit for residential and commercial solar properties. The commercial solar credit can be applied to both commercial customer sited solar systems as well as large scale utility systems such as solar farms. The solar industry in the U.S. has grown by more than 10,000% with the help of ITC being implemented in 2006.

-

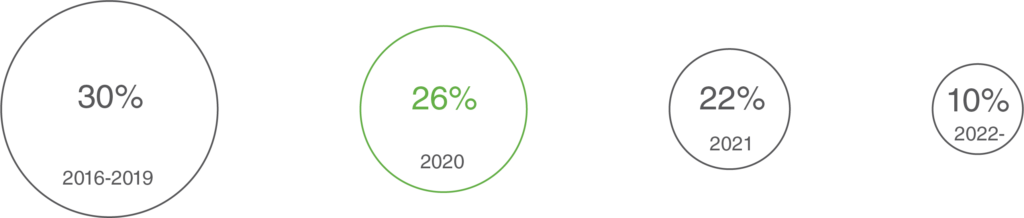

- 2016 to 2019: The tax credit allowed residential and commercial solar owners to deduct 30% of the costs for their system.

- 2020: Owners of residential and commercial solar are able to deduct 26% from the cost of their system.

- 2021: Residential and commercial solar owners are eligible for a tax credit of 22% of the cost of their system. This will also be the last year of federal tax credit eligibility for residential solar owners.

- 2022 and Beyond: Owners of new commercial solar will be able to claim 10% of the cost of their system.

- Who the tax credit applies too?

The ITC allows the homeowner to apply the credit to his/her personal income taxes. In order to qualify for the solar tax credit investment, you must own your solar energy system. In order to claim ITC, you will need to file under IRS 5695, you will then receive your tax credit when you file your taxes the year you installed solar. This is a tax credit not a refund, if you are unable to use the whole credit in one year the remaining credit rolls over to the next year as long as the tax credit is in effect. If you lease the solar from an installer you are unable to apply for the tax credit because you do not own the solar energy system.

- Ways the projects Qualifies

As the credit percentage reductions proceed, there are two pathways to secure a percentage by impending deadlines. The two ways to qualify include the 5% test and the Physical Work test.

-

- The 5% Test: This method to qualify requires the system owner to pay or incur at least 5% of the cost of the project before the construction start deadline. In this case, the “cost of project” only includes the portion of the project that qualifies for five-year accelerated depreciation. However, there is one exception to the rule, known as the “3 ½ month” rule. This means the equipment is treated as received on the date it was paid as long as the physical possession is taken within 3 ½ months from the first payment for the equipment.

- The Physical Work Test: This method involves physical work of a “significant nature” has commenced on a project. The IRS determines whether the work is considered significant based on the nature of work, rather than the cost or amount of that work. The catch is that only work done on equipment not normally held in inventory is eligible. Therefore, this method is not viable in commercial solar installations, with the exception of carports and projects with non-standard racking, due to the standardization of the equipment. On the other hand, both on-site and off-site work counts, making the physical work approach more accessible.

- Transfer Policies

For those who choose to buy solar equipment from after a deadline might wonder if they are eligible to receive the tax credit as well. The answer is yes; however, this is only true when the “project” is passed along instead of just the equipment. Here are some ways to ensure you will receive the credit:- Intangible Rights: These can include a Power Purchase Agreement (PPA), permits, interconnection agreement, or a site lease. In other words, you should look to contract rights because the more you have, the more likely you are to be approved for the transfer of the credit.

- Transferring to a Related Person/Party: The general requirement is that there needs to be a 20% overlap in ownership to be considered related. This is measured by the share of the profits if the company were to be liquidated. While corporations measure this by values in stock, individuals could include their siblings, spouses, parents, and children as related parties.

To stay up to date with Kern Solar Structures' blog, product updates and solar news subscribe the the Newsletter!

You must be logged in to post a comment.